Today, on 26/10/2022, the US kept its interest rate decision unchanged at 0.25%.

FOMC Statement

Following the release of the US interest rate decision, the Fed released their FOMC statement, some key points to note:

The Fed gave their timeline for the end of bond purchases for early March. However, starting in February, the Fed are to increase Treasury purchases by $20 billion and MBS purchases by $10 billion.

The Fed noted that It will be appropriate to raise the target Fed funds rate soon, and that they expect that reducing balance sheet size will start after the process of increasing the target range for the Federal Funds Rate has begun.

It was also reiterated that If risks arise that obstruct the Fed's goals, the Fed is prepared to change its monetary policy stance as needed. Job growth has been strong in recent months, and the unemployment rate has dropped significantly.

"We are ready to change any details on the balance sheet reduction in light of economic and financial developments."

FOMC Press Conference with Fed's Powell

In the press conference after this release, Fed's Powell stated that Omicron will undoubtedly have an impact on economic growth this quarter, If the wave passes swiftly, the economic impacts should follow suit. He stated that the labor market has made considerable improvement.

Inflation remains much beyond our long-term target, and supply issues are more severe and long-lasting than previously assumed, according to Powell. Inflation is predicted to fall during the year, and the Fed is committed to the goal of price stability.

"Given inflation and employment, the economy no longer needs ongoing high levels of support."

Both sides of our mandate demand for us to shift away from overly accommodating policy.

Fed's Powell reiterated that they have not taken any choices on the timeframe and rate of balance-sheet reduction, but that the balance sheet will be reduced after interest rates have begun to rise. There is a broad agreement on FOMC will soon be time to raise rates, with Fed's Powell eyeing the March meeting for the first interest rate hike in the US.

"This year's fiscal policy will be less favourable to growth."

Powell added that the fiscal stimulus to growth will be significantly reduced, which will also help to lower inflation. Because of the current state of the economy, we can move sooner and possibly faster than we did previously.

We will determine the timing, pace, and composition of the balance-sheet reduction, announce it, and keep it running in the background.

Powell commented, "If I were writing them today, I would increase my summary for economic projections on inflation for this year." and that he's inclined to increase his PCE forecast by a few tenths.

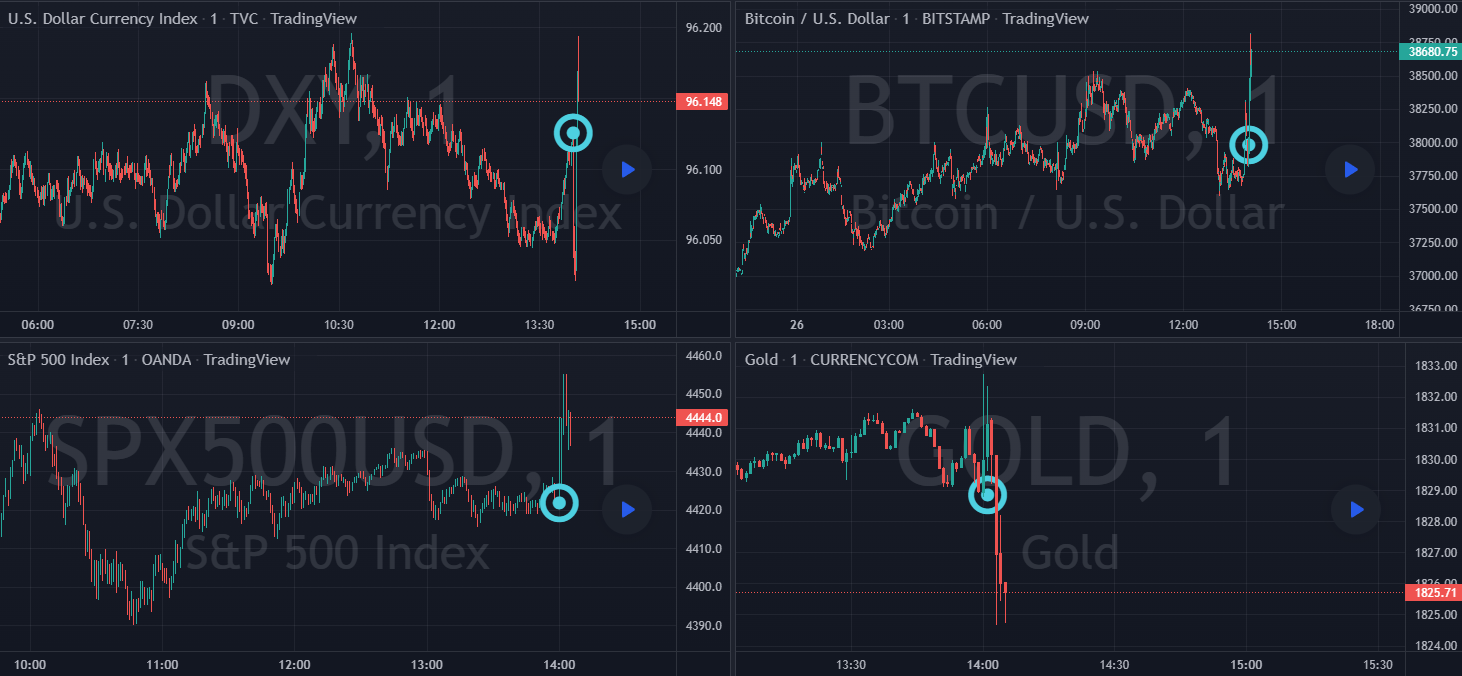

Market Reaction

The Interest rate decision initially caused the DXY to weaken, while the S&P 500 and Bitcoin strengthened.

During Fed's Powell's comments after the FOMC statement and the rate decision, the DXY extended its gains, while the US indexes erased them, with the S&P 500 and the Dow Jones turning negative on the session by the time Powell had finished his press conference.