On Wednesday, 14th of November at 2 PM ET, the FOMC is set to announce the latest change to the US interest rate, which is largely expected to be a 50 bps hike to 4.5%.

This would break the pattern from the previous 4 meetings, which have been jumbo-sized 75 bps hikes, and perhaps indicate a slowdown in the Fed's tightening cycle.

Alongside this, the Fed is also slated to release the rate statement, as usual - but more importantly - the Summary of Economic Projections (SEP), which is released 4 times a year after every other FOMC meeting.

Ahead of this pivotal event, here are some views on what to expect.

/cdn.vox-cdn.com/uploads/chorus_image/image/66668240/GettyImages_1209192403.0.jpg)

Wells Fargo

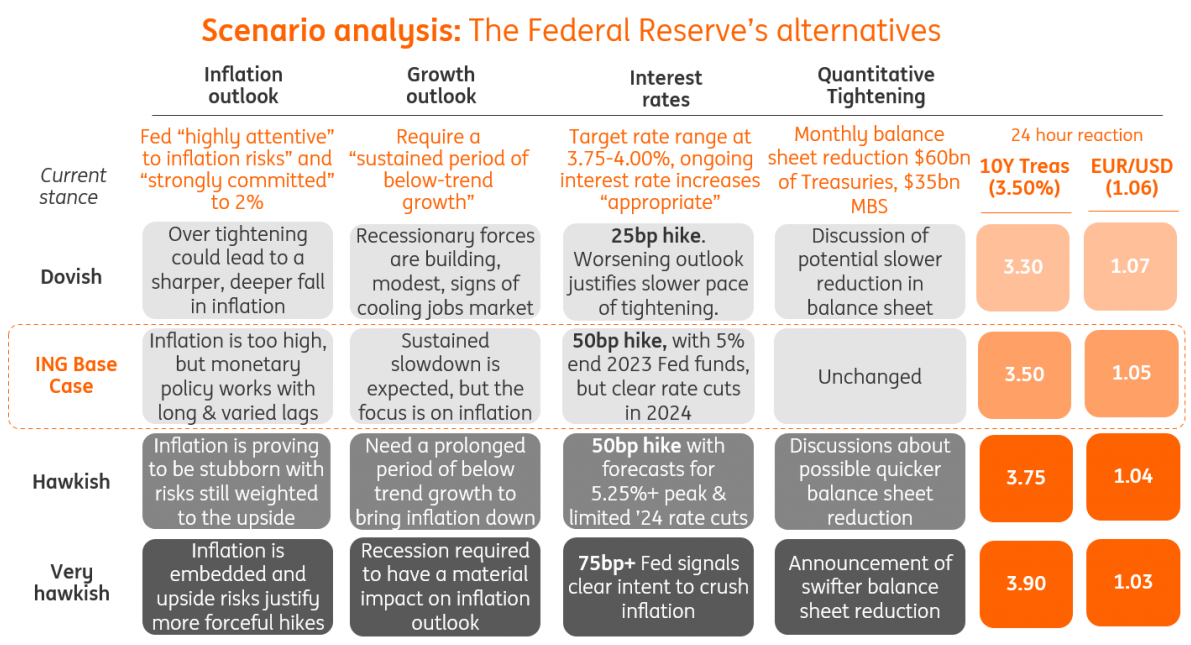

We expect to see the fed funds rate rise 50 bps to a range of 4.25%-4.50%. This represents a significant hike over the current range of 3.75%-4.00% but is still a downshift from the four consecutive 75 bps hikes at the prior four FOMC meetings.

We will also receive the next iteration of the Summary of Economic Projections (SEP), a series of charts and tables that signal Fed members' expectations of GDP growth, unemployment, inflation, and the Fed funds rate into 2025.

The FOMC's post-meeting statement and the SEP are likely to be positioned toward hawkishness even with the downshift in rate hikes. We look for the post-meeting statement to again note that "ongoing increases" in the fed funds target will be "appropriate," and we look for the so-called "dot plot" to shift higher. We now expect the end-of-2023 median fed funds rate estimate to reach 5.00%-5.25%, an increase of 50 bps since September, and where we expect the fed funds rate to be at the end of next year.

Key hawkish members of the FOMC have recently discussed the possibility of raising the terminal fed funds rate to or above 5% to continue to bring inflation down. We also expect that most FOMC members will continue to forecast a "soft landing" with only modestly weaker GDP growth rather than outright recession.

TD Securities

A hawkish tone in the FOMC statement and press conference, as well as upward revisions to the 2023 dots, should bear flatten the curve.

"The market is oscillating between a marginally easier Fed reaction function (a Fed that doesn’t want to “overdo tightening”) and a still-solid economic outlook coupled with high wages and service inflation (that will force the fed to keep hiking and push back against cuts)."

This means that volatile price action is likely to continue until one of these two narratives takes a clear lead.

We're leaning toward long duration, but waiting for better entry levels because strategists don't want to chase the current move due to thin year-end liquidity and low market conviction.

ING

A 50bp hike is widely expected given high inflation and a tight jobs market, but the market is pricing in a recession, and falling Treasury yields and a weakening dollar are undermining the Fed’s efforts to dampen price pressures.

The Fed will be concerned by the recent steep falls in Treasury yields and the dollar, coupled with a narrowing of credit spreads, which are loosening financial conditions – the exact opposite of what the Fed wants to see as it battles to get inflation lower.

We think the Fed is not finished with its rate hikes and its new forecasts will indeed indicate a higher path for the Fed funds rate to 5% with potential slight upward revisions to near-term GDP, and persistently high inflation forecasts used to justify this. Certainly, the consumer sector has been holding up better than many expected, with strong jobs and income gains supporting spending.

In terms of our view, we look for a final 50bp hike in February, taking the Fed funds ceiling to 5%. But like the market, we think a recession will dampen price pressures, and the composition of the US inflation basket, which is heavily weighted to shelter and vehicles, will facilitate a far faster drop in annual inflation readings than elsewhere.

Bank of America

The December FOMC statement should be hawkish and critical to the recent easing of financial conditions.

Tactical 5-year shorts are preferred.

It will take a more significant deterioration in economic fundamentals for UST yields to fall significantly below current levels.

Blackrock

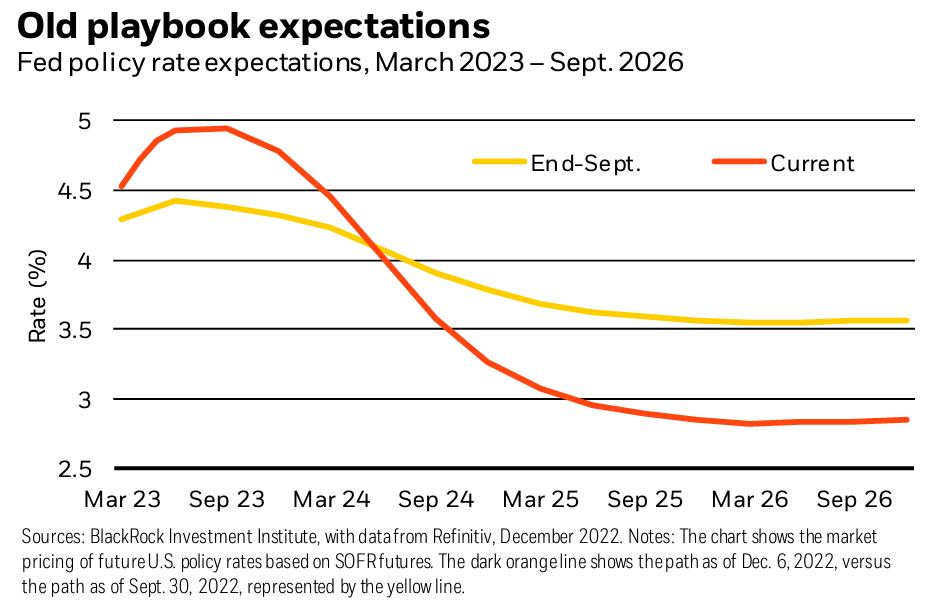

We expect central banks to keep rates high as a recession unfolds –not save the day as in the past. Yet Treasury yields have slid as the market expects Federal Reserve rate cuts, with the yield curve inverting more.

We think that incorrectly reflects hopes for an old recession playbook.

We think markets are pricing in rate cuts starting in mid-2023 (the dark orange line in the chart) because they think the Federal Reserve will ride to the rescue when a recession hits–the old playbook. That view has made U.S. yield curves the most inverted since the Fed’s last rapid hiking cycle in the 1980s, with five-year Treasury yields falling more than two-and 10-year yields over the past month. That’s boosted stocks.

JPMorgan

Dr. David Kelly

This Wednesday, the Federal Reserve will very likely announce a 0.50% increase in the federal funds rate, moderating the pace of increase from the last four meetings. They will also provide new forecasts for the federal funds rate which we expect to imply a total of 0.50% more in rate increases in early 2023, bringing the terminal rate to a range of 4.75% to 5.00%.

This is probably more restraint than the economy needs. The yield curve, as measured by the spread between two-year and ten-year Treasury yields, is at its most inverted since 1981, indicating expectations of both lower inflation and recession. The gap between five-year nominal Treasuries and five-year TIPS, which provides a forecast of CPI inflation rate over the next five years, has fallen from 3.6% at its peak last March to 2.3%.

"Futures markets suggest that investors expect the Fed to reverse course, cutting rates later in 2023 and in 2024."

This is especially important to bear in mind as Fed's Chair Powell could release a less Dovish message in his statement.

JPMorgan

Jay Barry

“It’s tempting to turn tactically bearish on duration, but we will be patient and remain neutral on duration"

Previous Release

The previous US interest rate decision took place on November 2nd, when the FOMC hiked rates by 75 bps from 3.25% to 4%, as expected.

This caused some upside movement in the S&P 500 & Gold, downside movement in the dollar, and some whipsawing in the US 10-year yield.

The prior rate statement for the November decision said:

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt, and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that was issued in May. "