US JOLTS Report Boosts Fed Rate Cut Bets - FJElite

US JOLTS Report came in lower than expected, which underlines lower demand for labor from US companies.

This feeds into the recession narrative for the US, as it shows deteriorating demand for labor amid a jobs market with an increasing unemployment rate, according to the latest US Employment Situation report.

This JOLTS data, representing July, is representing the same month as the previous nonfarm payrolls report

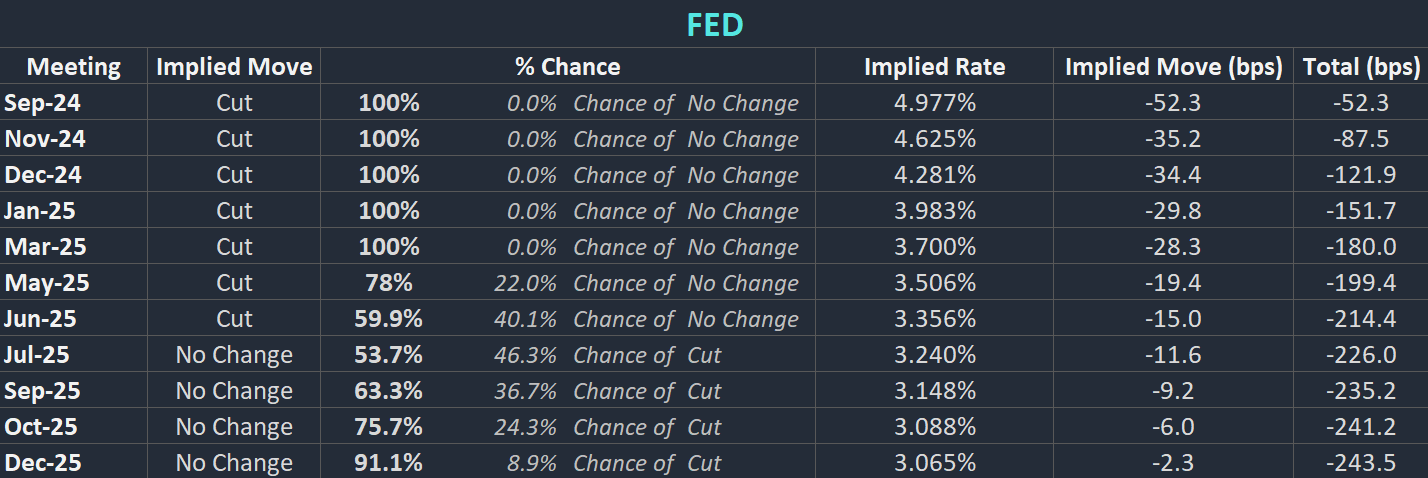

US interest rate futures increased the bps of Fed easing that is expected following this number.

They now see a 50 bps cut in September as more likely than a 25 bps cut.